Wall Street Journal writer Christina Rexrode reported recently that, “Small and midsize U.S. mortgage firms are trimming staff, putting themselves up for sale and closing up shop at a clip not seen in years, a sign of the mounting pressure on the housing market as interest rates rise and a long economic expansion matures.

“The number of nonbank mortgage lenders was down by about 3.5% at midyear from the end of 2017, according to the Conference of State Bank Supervisors. Mortgage-loan-originators at those firms dropped by more than 11,000 workers, or 7%, according to the group, which operates the system that processes mortgage licenses and registrations.

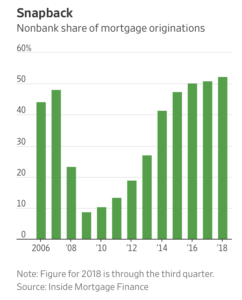

“The declines follow years of significant growth for nonbank lenders, which have taken mortgage-market share from traditional banks by being nimble and sometimes knowing local markets better. Led by larger firms such as Quicken Loans Inc., Freedom Mortgage and loanDepot, nonbanks made more than 52% of $1.26 trillion in originations in the first nine months of 2018, according to industry research group Inside Mortgage Finance.”

“Retreat of Smaller Lenders Adds to Pressure on Housing,” by Christina Rexrode. The Wall Street Journal (November 22, 2018).

The Journal article explained that, “Bankers and other industry watchers expect the ranks of smaller nonbank mortgage lenders to keep shrinking in coming months, as rising rates dry up the once-lucrative mortgage-refinancing business and make home purchases costlier. The nonbanks’ retreat adds to the concerns swirling about the health of the economy, particularly in the housing sector, which has slowed this year. Housing and lending are both major employers and widely followed leading indicators of future economic activity.”

The article added that, “‘Rising rates are headwinds to us,’ said Dan Gilbert, chairman of Quicken, the largest nonbank lender and one of the largest mortgage providers in the U.S., according to industry rankings. ‘When rates go low, those are tailwinds. But either way the plane has to fly,’ he said.

“The shakeout also reflects the straitened economics of the housing industry, where sales are slowing amid concerns about declining affordability, and rising costs for materials and labor are helping to narrow the pipeline of future construction projects.”