Justin Lahart reported this week at The Wall Street Journal Online that, “Lower interest rates were supposed to breathe new life into the housing market. But so far there are few signs of a real-estate revival.

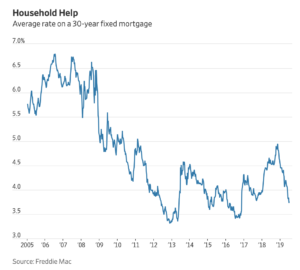

“Thanks in large part to the Federal Reserve’s dovish turn this year, mortgages have rarely been so cheap. As of last week, the average rate on a 30-year fixed was 3.75%, according to Freddie Mac, down from 4.73% a year earlier. Throw in an unemployment rate at nearly a 50-year low and improving household balance sheets and it seems like the housing market should have plenty of fuel.

“But housing doesn’t look so hot. The latest evidence of that came Wednesday as the Commerce Department reported that construction was started on an annualized 1.25 million new homes last month, fewer than the 1.27 million economists expected.”

“Cheap Mortgages Aren’t Enough to Spark Housing Boom,” by Justin Lahart. The Wall Street Journal (July 17, 2019).

The Journal article noted that, “There are a variety of forces that might be muting the effect of lower mortgage rates on the housing market. Would-be buyers have to qualify for a mortgage before they get one, for example, and lending standards remain far more stringent than they were before the financial crisis. Nor do Americans view homes as such a good investment as they used to.

“Then there is the issue of affordability: Home-price gains have moderated, but as of May prices were still up 3.6% from a year earlier, according to CoreLogic, outpacing the 3.1% in average increase in hourly earnings over the same period. Moreover, the 2017 tax overhaul effectively raised the costs of homeownership for many buyers, particularly in high-tax states.”