Bloomberg writer Lizette Chapman reported last week that, “It’s been a year since U.S. rules went into effect enabling anyone — not just the ultra-wealthy — to buy a slice of a startup.

“Turns out, few are interested.

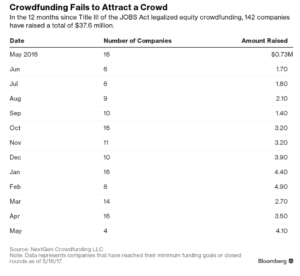

“Investors sprinkled about $38 million across 142 companies since May 2016 when Title III of the JOBS Act allowed equity crowdfunding for non-accredited investors, according to data from industry tracker NextGen Crowdfunding LLC.”

Graph from, “U.S. Startups Fail to Attract Crowd of Small Investors,” by Lizette Chapman. Bloomberg News (May 19, 2017).

The Bloomberg article noted that, “The slow start is a rounding error in the larger system — venture investors plowed more than $69 billion into startups during 2016, according to the National Venture Capital Association — and a little surprising, according to Richard Swart, a founding board member of the Crowdfunding Professional Association.

“‘Everyone in the industry thought there’d be more uptake,’ said Swart, who also serves as chief strategy officer at NextGen. ‘We all expected these numbers to be 2X to 5X what these numbers were.’

“Swat said the practice is still in its infancy. Wefunder, StartEngine and SeedInvest are the primary crowdfunding platforms, and many founders aren’t aware that equity fundraising is an option. Of those who explore it, many decide it’s not worth the hassle and expense.”

Last week’s article added that, “Technology startups, quite understandably, have largely ignored the new fundraising option because they benefit more from the existing system. Founders can raise an unlimited amount of money from accredited investors without spending a dime or having to broadly publicize company financial information. Cash from those investors is more valuable, too, because it comes with investors’ expertise and personal networks that founders can tap to hire employees and win customers.”