Jennifer Ifft and Todd Kuethe indicated recently at the farmdoc daily blog (“The Ongoing Debate over Farmland Taxation“) that, “All 50 U.S. states provide some form of preferential tax treatment for agricultural land. These tax policies were adopted state-by-state in response to the rapid loss of farmland associated with the rapid expansion of urban land use activities, following World War II. The majority of States tax farmland through a form of use-value assessment. Under use-value assessment, agricultural lands are taxed according to the potential earnings from agricultural production, rather than the full market value of the property. The goal of these programs was to limit farmers’ tax liability based on the belief that, in many areas, farmland market values were predominantly driven by the potential conversion to non-agricultural uses, such as housing or commercial development. The mechanisms used to measure potential earnings from agricultural have come under fire in a number of states, as a result of the recent declines in farm profitability. Farmers in a number of states have argued that the measures of ‘potential’ earnings drastically lag the realized decline in farm profit margins.

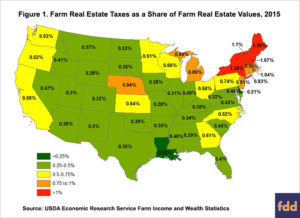

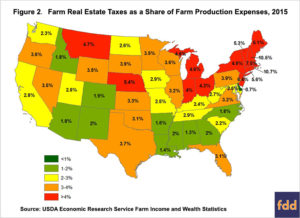

“The two most common concerns expressed by farmers are that (1) the effective tax rate exceeds the underlying value of the property [See Figure 1] and (2) the tax burden accounts for an outsized share of farm production expenses [See Figure 2].”

Figure 1 from, “The Ongoing Debate over Farmland Taxation.” (farmdoc daily, March 10, 2017).

Last week’s update noted that, “Figure 1 indicates a clear regional pattern. Effective tax rates are highest in the Northeast, at well above one percent of the farm real estate value. The lowest effective tax rates are found in Louisiana and Delaware, but the rates are relatively stable across most of the Midwest and Plains states.”

Figure 2 from, “The Ongoing Debate over Farmland Taxation.” (farmdoc daily, March 10, 2017).

And the farmdoc update added that, “The tax burden also indicates a clear regional pattern. Real estate taxes represent a larger share of production expenses in Northeastern States, but farm real estate taxes exceed four percent of total production expenses in a number of other states, including Indiana, Ohio, and Nebraska.”

“While farmland owners in all 50 States are given some form of preferential property tax treatment, a continued decline in farm profit margins will likely result in farmers requesting additional property tax relief,” the farmdoc update said.