Wall Street Journal writer Annie Gasparro reported late last week that, “When General Mills Inc. and Kellogg Co. couldn’t beat the startups appearing on store shelves next to their Yoplait yogurt and Froot Loops cereal, they decided to invest in them.

“Food giants are starting venture capital funds to invest in startups focused on healthier and less-processed foods, betting the younger companies can teach them to be more entrepreneurial and innovative. Slow to recognize consumers’ shift toward those products, global titans have found themselves stuck in a rut.”

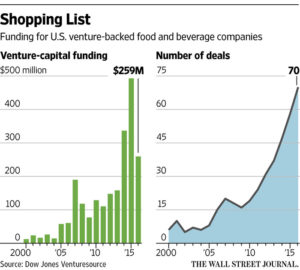

Graph from The Wall Street Journal.

The Journal article explained that, “‘It’s hard for consumer companies to step out of what they’ve been locked into for 60 or 80 years,’ said Ryan Caldbeck, founder and chief executive of CircleUp, a business that connects private-equity firms with food startups. CircleUp says large consumer-goods companies lost $18 billion in market share to smaller competitors between 2011 and 2015.”

“In total, venture capital funds made 66 food-and-beverage-related deals last year, up 20% from 2015. About a fifth were backed by big food companies, according to Dow Jones VentureSource,” the Journal article said.

Ms. Gasparro added that, “Rhythm Superfoods Chief Executive Scott Jensen said many of his peers are more open to a minority investment than a full acquisition. Some have heard cautionary tales of startups that slipped after teaming with big food makers, like Kellogg’s rocky pairing with cereal-maker Kashi.”