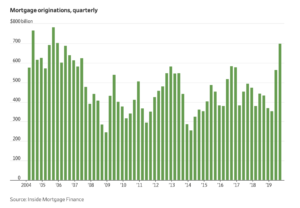

Wall Street Journal writers Ben Eisen and Laura Kusisto reported this week that, “The mortgage market turned red hot over the summer, posting its biggest three months since the financial crisis.

“Lenders extended $700 billion of home loans in the July-to-September quarter, the most in 14 years, according to industry research group Inside Mortgage Finance. Mortgage originations for the full year are on pace to hit their highest level since 2006, the peak of the last housing boom.

“Falling interest rates spurred homeowners to trade higher-rate mortgages for lower-rate ones to save on monthly payments. Refinancings kept mortgage lenders busy, though home sales haven’t recovered as much as economists expected.”

“Falling Rates Boost Mortgage Market to Precrisis Levels,” by Ben Eisen and Laura Kusisto. The Wall Street Journal (October 28, 2019).

The Journal article noted that, “Home sales have risen on an annual basis for the past three months, according to the National Association of Realtors, reversing a slowdown that persisted for more than a year. But sales fell about 2% in September from August, indicating the market is struggling to maintain its newfound momentum.

“A decline in mortgage rates often takes longer to boost home purchases than refinancing because people need to shop for a home first. That could mean a few more months of improving sales as buyers who were drawn back into the market by lower rates continue to close on their purchases.”