Last week, Wall Street Journal writer Ben Eisen reported that, “Mortgage rates are fast approaching 4%, a rate low enough that economists and lenders believe it will help jump-start the housing market again.

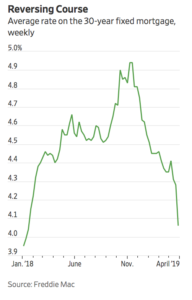

“The average rate on a 30-year fixed mortgage fell to 4.06% this week, its lowest since January 2018, according to data released Thursday by Freddie Mac , the mortgage-finance giant. The rate was down nearly a quarter point from a week earlier, its biggest drop in over a decade.

“In many cases rates are lower than 4%. Lenders advertising mortgages at sub-4% rates this week include Toronto-Dominion Bank,HSBC Holdings and Teachers Federal Credit Union, according to Bankrate.com.”

“The 4% Mortgage Is Back,” by Ben Eisen. The Wall Street Journal (March 28, 2019).

The Journal article noted that, “Just a few months ago, average rates were on the verge of hitting 5%, drying up refinancings and putting a damper on home price growth. While the housing market remains cooler than it had been at its peak, lower mortgage rates are again raising hopes for a rebound as the spring selling season gets under way.

“Mortgage rates have been declining along with the yield on the benchmark 10-year Treasury note. The moves have been spurred by the Federal Reserve’s decision to pause its interest rate increases along with investor malaise about the expected pace of economic growth for the rest of the year.

“That has created an opening for prospective buyers left on the sidelines after rates jumped.”