Wall Street Journal writers Ryan Dezember and Laura Kusisto reported this week that, “Wall Street is betting that more well-off Americans will want to be renters.

“Financiers who loaded up on homes after the housing bust for pennies on the dollar are buying yet more—despite home prices in many markets being at all-time highs.

“Their wager: High prices, higher mortgage rates and skimpy inventory are making homeownership harder. Well-to-do families who might have bought a single-family home in another era are willing to rent a house now, especially if it means access to a good school system.”

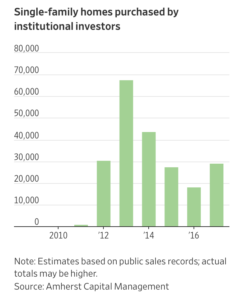

The Journal article noted that, “The number of homes purchased by major investors in 2017 was at least 29,000, up 60% from the previous year, estimates Amherst Capital Management LLC, a real-estate investment firm with an affiliated business that made nearly 5,000 of those purchases.”

“House Money: Wall Street Is Raising More Cash Than Ever for Its Rental-Home Gambit,” by Ryan Dezember and Laura Kusisto. The Wall Street Journal (July 9, 2018).

Dezember and Kusisto explained that, “This year, investors have raised billions of dollars from bond buyers, pension funds and even wealthy Chinese individuals to purchase more homes. They have been particularly aggressive buyers in places like Atlanta, Phoenix, and other metro areas with good schools and faster-growing economies.”

This week’s article added, “Cash to acquire and renovate homes has become so abundant lately that some rental investors can’t spend it fast enough. Without enough homes to buy, some investors are now building their own in popular residential markets like Miami and Nashville, Tenn.—upending a traditional pattern of Americans buying starter homes and moving up.”