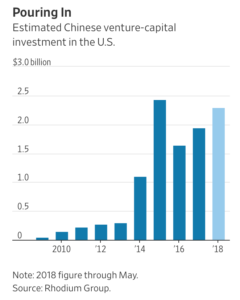

Wall Street Journal writers Kate O’Keeffe and Eliot Brown reported earlier this month that, “Tighter national security reviews have curbed Chinese deal-making in the U.S., but a new study shows China is pouring money into cutting-edge American technologies at a record pace this year through loosely regulated venture capital investments.

“Chinese foreign-direct investment into the U.S., made through deals such as acquisitions, fell into negative territory during the first five months of the year, according to data that takes asset sales into account from the Rhodium Group, a New York consulting firm.

“Yet the figures belie China’s sustained interest in U.S. technology, which it is continuing to target through relatively unrestricted investments in startups in Silicon Valley and elsewhere, Rhodium said in a new report reviewed by The Wall Street Journal.”

“China Targets U.S. Tech Startups in Investment Loophole,” by Kate O’Keeffe and Eliot Brown. The Wall Street Journal (July 16, 2018).

The Journal writers noted that, “The report’s findings could give fresh momentum to national security hawks who have singled out Chinese investment as posing disproportionate risks to the U.S. because the entities may be directed and subsidized by the government of China, an economic and military rival.

“Over the period from January to May 2018, Chinese venture capital investment in the U.S. had already reached nearly $2.4 billion, which was its previous full-year record set in 2015, according to Rhodium’s analysis.

“From 2000 through May 2018, Rhodium found more than 1,300 funding rounds of U.S. startups with at least one Chinese-controlled investor, representing an estimated $11 billion in Chinese investment. Around three-quarters of those transactions have occurred since 2014, the report by Thilo Hanemann, Adam Lysenko and Daniel Rosen, says.”

The Journal article explained that, “Venture capital is defined by investments targeting startups with big potential that require large amounts of money in early days. It typically involves groups of investors that each take small stakes and gradually put in more money as the company grows.

“Chinese investors targeting startups have historically focused their investments in the information and communications technology sectors as well as the health, pharmaceuticals and biotechnology sectors, Rhodium found. They are also targeting technologies such as 3-D printing, robotics and artificial intelligence, and recently have plowed money into companies such as Grail, a Silicon Valley cancer detection startup, the report said.

“The new data on venture investing, which is notoriously hard to track given complex legal structures and limited disclosure requirements, comes amid an array of potential actions by the U.S. government to further regulate foreign tech investing.”