Wall Street Journal writers Jonathan D. Rockoff and Preetika Rana reported recently that, “Fledgling biotechs and medical-technology startups in the U.S. and Europe have found a new source of funding for their costly research: China.

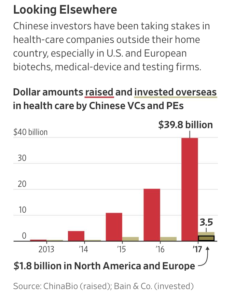

“Foreign health-care investments by Chinese venture-capital and private-equity firms reached a record $3.5 billion last year, up from $500 million four years earlier, according to Bain & Co. Much of the new money has gone to buying stakes in U.S. and European firms.

“For some Western life-sciences firms, such funding has become instrumental. All nine named investors in a $300 million financing round last month for Grail Inc, a blood-testing startup based in Menlo Park, Calif., were from Hong Kong or mainland China.”

“China’s Investors Pour Into Western Biotech Startups,” by Jonathan D. Rockoff and Preetika Rana. The Wall Street Journal Online (June 14, 2018).

The Journal writers noted that, “Yet the influx has raised concerns among industry officials and advisers that some valuations are getting excessive and that inexperienced investors from China may underestimate the risks and flee in a downturn.”

The article also pointed out that, “The sector’s strong performance in recent years is a major draw for money managers in China, who have been running out of places there to invest rapidly growing funds. China’s venture-capital and private-equity funds focused on health care raised $40 billion last year, double the amount raised a year earlier, according to Shanghai-based consultancy ChinaBio.”

“Chinese fund managers and investors see the money-making potential in bringing the Western drugs, devices and diagnostics they have invested in to their home country. The Chinese government has been encouraging the development of a life-sciences sector in the country,” the Journal writers said.