Wall Street Journal writers Phred Dvorak and Yasufumi Saito reported yesterday that, “Silicon Valley, long the undisputed king of venture capital, is now sharing its throne with Asia.

“A decade ago, nearly three-quarters of the world’s financing of innovative, tech-heavy startups and young companies took place in the U.S., with American investors plowing money into mostly U.S.-based venture firms.

“Now, a surge of new money—mostly from China—has helped drive funding totals into the stratosphere and has transformed the venture landscape, according to an exclusive Wall Street Journal analysis of venture funding data.”

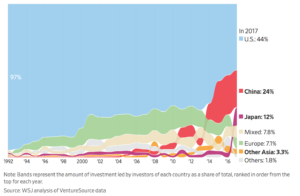

Venture capital by place of origin, share of total- “Silicon Valley Powered American Tech Dominance—Now It Has a Challenger,” by Phred Dvorak and Yasufumi Saito. The Wall Street Journal Online (April 12, 2018).

The Journal writers explained that, “Asian investors directed nearly as much money into startups last year as American investors did—40% of the record $154 billion in global venture financing versus 44%, the Journal’s analysis of data from private markets data tracker Dow Jones VentureSource found. Asia’s share is up from less than 5% just 10 years ago.

“That tidal wave of cash into promising young firms could herald a shift in who controls the world’s technological innovation and its economic fruits, from artificial intelligence to self-driving cars.”

Yesterday’s Journal article added that, “Silicon Valley previously was far and away the leader for tech entrepreneurs in both money and know-how, says Kai-Fu Lee, a veteran tech executive who headed China units of Microsoft and Google before founding his own Beijing-based venture-capital firm, Sinovation Ventures, in 2009. The rise of China’s venture market ‘signifies a shift from a single-epicenter view of the world to a duopoly,’ he says.”