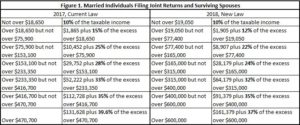

An update yesterday from the American Farm Bureau Federation’s Market Intel group indicated that, “The Tax Cuts and Jobs Act (H.R. 1) will deliver modest tax reductions for W-2 earners in the form of modified individual tax brackets, which are included below. The bill attempts to simplify tax preparation for taxpayers by eliminating deductions that impacted a fairly small number of filers and replacing them with a higher standard deduction. In 2017, the standard deduction for a joint return was $12,700. In 2018, the figure will climb to $24,000. In addition, individual rates have been adjusted downward and the brackets expanded so that a larger amount of income is subject to lower rates. Figure 1 compares the 2017 and 2018 individual tables.”

“What Do the Tax Cuts Mean for Farmers and Ranchers?” American Farm Bureau Federation, Market Intel (December 20, 2017).

The AFBF update noted that, “Given that 93 percent of U.S. farms file their taxes through the individual code, these changes are important. However, the business provisions that impact farms, ranches and other pass-through businesses offer the greatest chance of improvement for agriculture.”

Yesterday’s update added that, “The conference bill provides that individuals operating pass-through businesses will be able to take a deduction for 20 percent of their business income through Dec. 31, 2025. This is a small reduction from the Senate bill which would have allowed for a 23 percent deduction. As in the Senate version, the deduction is unlimited below a joint household income, though the threshold of $315,000 in the final bill is significantly lower than the $500,000 threshold in the Senate version.”

The Market Intel update also included a large- detailed table that compares the business provisions of current tax code and the Tax Cuts and Jobs Act; the table can be viewed here.