Li Yuan indicated yesterday at The Wall Street Journal Online that, “David Su was one of China’s first venture capitalists. A month after starting out in 2000, the dot-com bubble burst. For much of the year, he and his partners scraped to raise $33 million to invest in China’s nascent internet industry.

“Despite that initial challenge, Mr. Su proved adept in early-stage investing. His portfolio includes search-engine giant Baidu Inc., ride-sharing giant Didi Chuxing Technology Co. and bike-sharing app Ofo. His Matrix Partners China, which he co-founded in 2008, has nurtured 20 ‘unicorns,’ or startups valued at $1 billion or more.

“Even with all that experience and success, Mr. Su says he feels as anxious now as he did back in 2000, if for a very different reason.”

The Journal article stated that, “While capital back then was hard to come by, now the market is flooded with funding. Mr. Su and other venture capitalists compete with Chinese government-backed funds, mega-investors like SoftBank Group Corp. and tech giants Tencent Holdings Ltd. and Alibaba Group Holding Ltd.

“‘In my 18 years in the industry, the tide of capital is riding extremely high this year,’ Mr. Su told me.

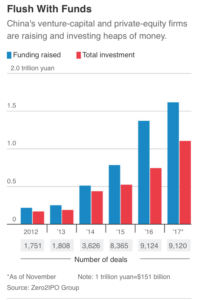

“In the first 11 months of this year, 3,418 new venture-capital and private-equity funds in China raised 1.6 trillion yuan ($241.76 billion), more than double the amount of 2015 and more than 10 times that of 2006, according to consultancy Zero2IPO Group. It estimates about 12,000 investment firms manage 8.5 trillion yuan in capital, an increase from 8,000 firms managing 5 trillion yuan in 2015.”

“China’s Wild Bunch: Startup Investors Are Cashed-Up Cowboys,” by Li Yuan. The Wall Street Journal Online (December 14, 2017).

Yesterday’s article noted that, “It results in over-the-top valuations, intense competition for good startup targets and greater uncertainty for funders about whether or when their investments will pay off.

“Mr. Su used to spend weeks and months researching companies and getting to know the founders. With founders now flush with offers, Mr. Su and his colleagues are under pressure to move much faster. In some instances, he says, he was negotiating with a startup in his office in Beijing while rival financiers waited downstairs in the building lobby with contracts in hand.

“A few times, he and his partners had to decide whether to invest in a startup in three hours, he says. There was no time to do due diligence.”

The Journal article added that, “Out of 221 unicorns in the world, 59 are in China, according to CB Insights. While that may lag behind the 127 from the U.S., it’s ahead of the U.K.’s 12 and India’s nine. Many Chinese investors want to invest in Silicon Valley because they think the valuations there are more reasonable.”