Justin Lahart reported on Tuesday at The Wall Street Journal Online that, “There are lots of good reasons for startups to stay private, and no one knows that better than Julie Wainwright.

“She is the founder of RealReal, a successful privately held online retailer that has gone through seven rounds of funding. Ms. Wainwright was also the CEO of Pets.com, which shut down when the cash ran out in Nov. 2000, seven months after going public.

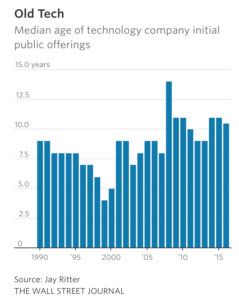

“The flood of cash into startups has allowed companies to stay private for far longer than in the past. On the positive side, companies have more time to develop and grow. But the lack of a public market valuation also raises the question of whether many companies are worth the $1 billion-plus values private investors have attached to them.”

“Startups That Never Grow Up,” by Justin Lahart. The Wall Street Journal Online (October 31, 2017).

Mr. Lahart noted that, “A lot of richly valued startups are so old that saying they need time to develop and grow is a bit of a joke. Ride-hailing service Uber, which is valued at $68 billion, has been around for over eight years. Big-data analysis firm Palantir, valued at $20 billion, is 13 years old. SpaceX, the Elon Musk -led rocket maker valued at $21 billion, is 15 years old.”

The article added that, “With all that money riding on them, companies may be scared to go public during less-than perfect market conditions, worried that they will end up like food company Blue Apron. It was valued at $2 billion before going public this June and now has a market capitalization of less than $1 billion.

“Yet right now, with the U.S. economy in the ninth year of an economic expansion and the stock market clocking new highs, is the perfect time to go public. What are they waiting for?”