Tom Meersman reported recently at the Minneapolis Star-Tribune Online that, “Matthew Fitzgerald was at the wheel of a tractor last week near Hutchinson, Minn., flames from a customized cultivator trailing him as the last step in his efforts to rid the grass and weeds from the rows of organic corn plants.

“The unusual cultivation is one of several techniques that are growing in favor as millennials and others push farms away from herbicides toward organic production. Fitzgerald, 25, describes it as a ‘giant grill for weeds,’ and he and other young farmers are changing the industry, from embracing new methods to sharing information through social networks.

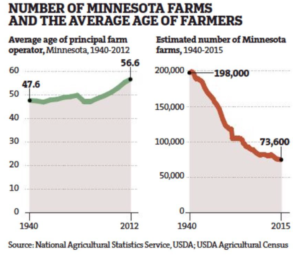

“Their numbers are still small — only 4 percent of principal farm operators in the state are under the age of 35 and the average age is 56, according to federal census numbers. But Fitzgerald is part of a movement of young farmers to increase their ranks. The National Young Farmers Coalition considers a recent law passed in Minnesota to be a major win for its cause.”

Graph from, “First-of-its-kind law aims to help young farmers find their footing in Minnesota,” by Tom Meersman (Minneapolis Star-Tribune, July 1, 2017).

The article explained that, “The law, a first of its kind in the U.S., aims to give beginning farmers a leg up — or at least a fighting chance — to get access to farmland by providing tax credits to the landowners who sell or rent land or farm equipment to them.

“‘The No. 1 barrier for beginning farmers is access to land,’ Fitzgerald said. ‘There’s lots of good workshops and resources and programs that can help people who are interested in farming, but ultimately when it comes down to it, you need to get on some soil to be a farmer.’

“Over the next 20 years, 573 million acres of farmland across the country will change management, according to the coalition.”

Mr. Meersman added that, “Details of how to implement the Minnesota law are still being worked out by state departments of agriculture and revenue, but an early estimate predicted that it could help 370 farmers annually — half renters, half buyers — once it takes effect in 2018.

“The law offers landowners a 5 percent state income tax credit if they sell land or machinery to new or beginning farmers, 10 percent if they rent land or equipment and 15 percent if they set up a crop share agreement. To be eligible for the program, the beginning farmer needs to have farmed for 10 years or fewer and must take an approved farm management course. Landowners could not qualify for tax credits if they sell or rent to their own family members.

“Iowa and Nebraska offer similar tax credit programs for land rental, but Minnesota will be the first state to also allow the credits on land sales.”