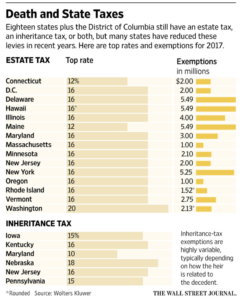

Laura Saunders indicated last week at The Wall Street Journal Online that, “Want proof taxes can actually go down? In the past three years, nine states have eliminated or lowered their estate taxes, mostly by raising exemptions.

“And more reductions are coming. Minnesota lawmakers recently raised the state’s estate-tax exemption to $2.1 million retroactive to January, and the exemption will rise to $2.4 million next year. Maryland will raise its $3 million exemption to $4 million next year. New Jersey’s exemption, which used to rank last at $675,000 a person, rose to $2 million a person this year.

“Next year, New Jersey is scheduled to eliminate its estate tax altogether, joining about a half-dozen others that have ended their estate taxes over the past decade.”

Graphic from The Wall Street Journal (“Why More States Are Killing Estate Taxes.”)

The Journal item noted that, “While most recent changes have been to state estate taxes, some states with inheritance taxes are feeling pressure as well. Six states have these levies, which are payable by the person who inherits assets rather than the estate of the person who died. States can have either one of the taxes, or both.”