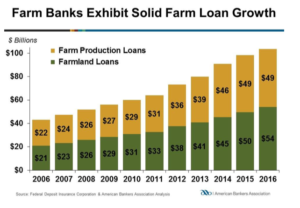

Earlier this week the American Bankers Association (ABA) indicated in a news release that, “Farm banks increased agricultural lending by 5.3 percent in 2016 and held $103.4 billion in farm loans at the end of the year, according to the American Bankers Association’s annual Farm Bank Performance Report.

“Asset quality remained healthy at the nation’s 1,912 farm banks as non-performing loans have fallen to a pre-recession level of 0.54 percent of total loans. ABA defines farm banks as banks whose ratio of domestic farm loans to total domestic loans is greater than or equal to the industry average.”

Graph from, “2016 Farm Bank Performance Report.” American Bankers Association (May 3, 2017).

The update noted that, “Farm banks continued to build high-quality capital over the year. Equity capital at farm banks increased 3.7 percent to $48.4 billion in 2016, while Tier 1 capital increased by $2.6 billion to $45.9 billion. Farm banks have built strong high-quality capital reserves and are well-insulated from risks associated with the agricultural sector.”

The ABA news item added that, “Farm banks added more than 2,600 jobs, a 3 percent increase, and employed more than 91,000 rural Americans. Since 2007, employment at farm banks has risen 24.3 percent.”