Eliot Brown reported on the front page of today’s Wall Street Journal that, “Eighteen months ago, Beepi Inc. was rapidly expanding its online used-car business to 16 U.S. cities where people could buy cut-rate vehicles adorned with giant shiny bows.

“Beepi doesn’t exist anymore. After burning through more than $120 million in capital, the startup failed to raise more cash and shut down in February. Its roughly 270 employees cleared out of the cavernous Mountain View, Calif., headquarters, leaving behind the ping-pong table and putting green.

“Beepi’s rapid demise offers a glimpse into the changing fortunes of Silicon Valley startups, many of which have struggled to adjust since a two-year investment frenzy came to an end.”

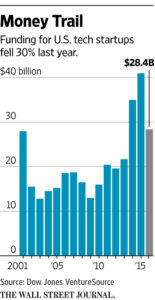

Graph from today’s Wall Street Journal.

Today’s article noted that, “In 2014 and 2015, mutual funds, hedge funds and other investors pumped billions into companies that they now see as overvalued, and unlikely to pull off an initial public offering. As venture capitalists became more discerning, investment in U.S. tech startups plummeted by 30% in dollar terms last year from a year earlier.”

The Journal article explained that, “Venture-capital firms remain flush with cash: They raised $44 billion last year, the most since the dot-com boom.

“But investors are staying away from scores of initially well-funded startups that once looked like relatively safe bets, forcing these companies to fight for survival as they burn through their stockpiles of cash and scramble for new money or buyers.”

Mr. Brown added that, “Seemingly every week lately, a well-funded startup is slashing jobs or pulling the plug.

“In recent months, mobile-search startup Quixey Inc. shut down after raising over $100 million, health-benefits broker Zenefits—which has raised more than $500 million—laid off nearly half of its staff, and blogging platform Medium cut one-third of its employees after raising $132 million.

“Such closures and cutbacks were rare two years ago when venture capitalists encouraged startups to expand rapidly to edge out competitors. Then when capital became scarcer, investors urged companies to turn profitable, which isn’t an easy pivot.”