Michael Langemeier indicated in an update last week at the farmdoc daily blog (“How Should Farm Business Income be Divided?”) that, “If everyone in the farm business owned a similar amount of business assets, worked the same number of hours, and provided management expertise, the answer to the question in the title would be very straightforward. In this unlikely scenario, business income could be split equally. Unfortunately, asset ownership, hours worked, and management responsibilities vary across managers, operators, and owners of the business. This increases the importance of coming up with a conceptual framework to divide farm business income. This article describes a model that can be used to divide farm business income, and provides an illustration of how this model can be used in practice.”

The update noted that, “Hofstrand (2016) describes two methods that can be used to divide business income between parties in the business in an equitable manner. These two methods are the contributions model and the 50/50 model. With the contributions model, which is the focus of this article, an annual contribution is computed and allocated to each party before splitting net income. Annual contributions are computed using the relative value of each party’s contribution of resources to the farm business.”

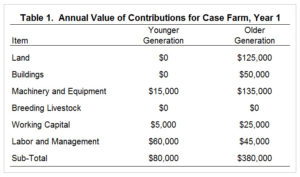

Dr. Langemeier explained that, “Resources that need to be included in the contributions model include land, buildings, machinery and equipment, breeding livestock, working capital, and labor and management.”

Graph from the farmdoc daily blog, “How Should Farm Business Income be Divided?” (March 31, 2017).

The farmdoc update added that, “Table 1 contains an illustration of how the contributions model can be used to divide business income. This illustration assumes that there are two parties involved, a younger and an older generation. In this illustration, the older generation owns the vast majority of the land, buildings, machinery and equipment, and working capital…[I]t is important to note that the annual contributions reported in table 1 are distributed before net income is split between the parties.”

“The annual value of the contributions will need to be updated every year to account for changes in owned acres, building values, machinery and equipment values, and working capital. When dealing with a younger generation and an older generation, what typically happens is the annual contribution of the younger generation increases over time while the annual contribution of the older generation decreases over time. If assets were purchased together, the ownership shares would need to be divided accordingly. It is also important to note that if assets are disposed of the sales amount needs to be divided using the ownership percentages,” the farmdoc update said.