Laura Saunders indicated in Saturday’s Wall Street Journal that, “New cases of tax-identity theft have dropped sharply following coordinated efforts by tax agencies and preparers, but filers need to stay vigilant.

“Tax-ID theft, also called tax-refund fraud, occurs when a criminal uses stolen personal information to file a return in someone else’s name and receive a bogus refund. The thief claims the bogus amount whether or not the actual filer is due a refund.

“Victims are often unaware of the crime until a computer rejects the real return. Correcting the problem is often onerous and can take months.”

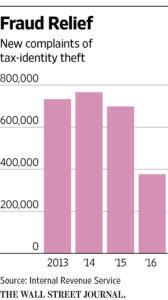

The Journal article explained that, “During 2016, the Internal Revenue Service received 376,000 new reports of tax-ID theft involving federal returns, less than half the total of 766,000 during the peak year of 2014. The agency also estimates that it rejected almost $6.6 billion in fraudulent refund claims in 2016, compared with $8.7 billion in 2015, indicating that thieves were less active. About 150 million individual returns are filed annually.”

Graph From The Wall Street Journal.

Some of the tips to protect against tax-ID theft contained in the Journal article included:

“-Push your preparer. Respected stand-alone accounting firms are a rich target now, experts say. Clients of these firms often pay taxes in April but don’t file returns for up to six more months after getting an extension—so the information is valuable to thieves in the meantime. Ask about the firm’s cybersecurity.

–Minimize tax refunds. The average refund now tops $3,000, and ID theft victims have to wait months for theirs. If you adjust withholding to get a lower refund or even small bill for tax due, there will be less pain if you’re a victim.

–Don’t be lazy with passwords. Make them strong and don’t use the same one for different portals, especially if you do your taxes online.”