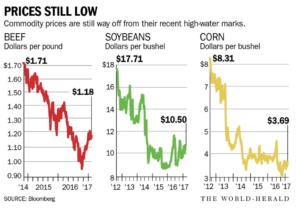

Cole Epley reported in Sunday’s Omaha World-Herald that, “This year, U.S. farmers are expected to net profits of $62.3 billion, or one-half of the record $123 billion they reaped in 2013, according to last week’s USDA report. For many producers facing a fourth consecutive year of declines amid persistently depressed commodities prices, breaking even is a best-case scenario in 2017.

“For Jeff Metz, who raises cattle and grows wheat on 5,000 acres of land near the Panhandle community of Bridgeport, the outlook is bordering on untenable…[M]etz also has endured cratered cattle prices that today ring up at only half of last year’s levels. Selling calves for $800 a head after they brought up to $2,000 in recent years only magnifies input costs for expenses like property taxes and feed, Metz said.”

Graph from Sunday’s Omaha World-Herald.

Sunday’s article noted that, “Then there’s the wheat business.

“The government forecast for wheat prices pegged a year-over-year decline of $1.4 billion, or 17 percent. Record harvests around the world have led to a global glut, and that in combination with a stronger dollar has crumbled the export market to decades-low levels.”

The article pointed out that, “‘We’re losing a dollar for every bushel that we produce,’ Metz said, ‘and it isn’t going to take long before I’ve got a wheat farm for sale.’

“Such financial stresses remain evident in regional banking data recently assessed by the Federal Reserve Bank of Kansas City…Nathan Kauffman is the Kansas City Fed’s Omaha branch executive and sees growing apprehension from both lenders and borrowers when it comes to taking on additional debt. Last year a ‘relatively small’ group of borrowers were facing real financial problems, Kauffman said, and the odds are increasingly in favor of that group growing.

“That could be why demand for new loans suddenly dropped in the fourth quarter.”

The World-Herald article indicated that, “Among banks in the Fed’s 10th district, which includes Nebraska, new originations of non-real estate farm loans fell off by 40 percent in the fourth quarter, according to a report Kauffman wrote late last month. It’s been almost 20 years since bankers recorded such a decline, and the precipitous drop capped a year in which bankers reported historic or near-historic demand for operating loans.

“Kauffman theorizes that many borrowers and lenders finally have sated their appetites for risk and debt as they buckle up for another year of low commodities prices.”

Sunday’s article added that, “Borrowers in business with First National Bank of Omaha, which has about $1.5 billion in farm loans and is perennially neck-and-neck with cross-town competitor Pinnacle in terms of such loans, already have dialed back, says Tom Jensen, the bank’s senior vice president of ag lending…[F]irst National has tempered its outlook in terms of what it expects to see for farm loan demand in 2017. For those that stay, the odds are good for many that they are due for drastic changes.

“‘After the (farm crisis in the) ’80s, we thought we would have more weekend farmers and see more of them carrying jobs during the week,’ First National’s Jensen said. ‘I think there will be more of that.'”