Dale Lattz indicated last week at the farmdoc daily blog (“Understanding Coverage Ratio, a Measure of the Ability to Repay Loans“) that, “Completing financial statements and having a good understanding of where their business stands will be very important as farmers meet with their lender when initiating and renewing loans for 2017. The last three to four years of low farm incomes have resulted in tight cash flows, placing lenders in a much more cautious state of mind. From a lender’s standpoint, just as important as having adequate collateral to back up a loan is the ability to project adequate cash flow to repay existing and new loan obligations.

“Financial statements will need to be prepared and include an income statement and balance sheet. These two statements measure the business’s profitability for the year just completed and the equity or solvency of the business. Just as important will be preparing a 2017 projected cash flow statement, which provides a measure of the business’ ability to meet debt obligations. The desired result is for the business to demonstrate that it can generate enough cash flow to meet family living needs, pay income taxes and have cash remaining to meet term debt obligations. The Coverage Ratio, which equals cash flow divided by term debt requirements, measures this ability. The Coverage Ratio needs to be a at least 1.0 but ideally a higher ratio is preferred to allow for any unexpected shortfalls in the projected cash flow. These shortfalls can come about due to lower prices, lower yields and/or higher costs than what the original projections used.”

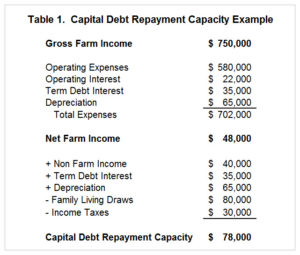

Mr. Lattz noted that, “The two major components of the coverage ratio are the Capital Debt Repayment Capacity (CDRC) [Table 1] and the Annual Debt Service Requirements (ADSR) [Table 2].

Table 1, from farmdoc daily, January 2017.

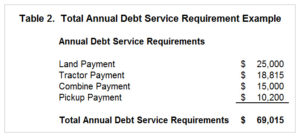

Meanwhile, “Table 2 illustrates an example of Annual Debt Service Requirements.”

Table 2, from farmdoc daily, January 2017.

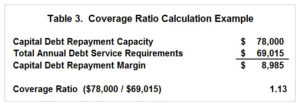

The farmdoc update then noted that, “Once these two components have been calculated, the Capital Debt Repayment Margin and Coverage Ratio can be calculated. The Capital Debt Repayment Margin is simply CDRC minus the ADSR. The Coverage Ratio is calculated by dividing the CDRC over ADSR.”

Table 3, from farmdoc daily, January 2017.

Mr. Lattz added that, “In today’s agricultural economy with lower grain prices, some farm operations may be projecting a Coverage Ratio of less than 1.0. In 2015, the Coverage Level averaged less than 1.0 in Illinois (farmdoc daily, October 4, 2016). If this is the case, the next question is how much is the shortfall and does the business have adequate working capital to cover the shortfall. This maybe a short-term solution but depending on the magnitude of the shortfall and level of working capital might not and should not be a long-term solution.”