Kirsten Grind and Peter Rudegeair reported in Thursday’s Wall Street Journal that, “House flipping, a potent symbol of the real-estate market’s excess in the run-up to the financial crisis, is once again becoming hot, fueled by a combination of skyrocketing home prices, venture-backed startups and Wall Street cash.

“After nearly being felled by real-estate forays almost a decade ago, a number of banks are now arranging financing vehicles for house flippers, who aim to make a profit by buying and selling homes in a matter of months. The sector is small—participants say roughly several hundred million dollars in financing deals have been made in recent months—but is expected to keep growing.”

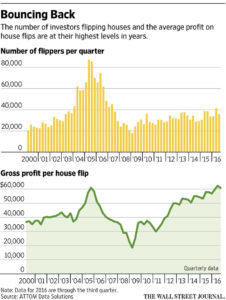

Graph From The Wall Street Journal.

The Journal writers explained that, “The number of investors who flipped a house in the first nine months of 2016 reached the highest level since 2007. About a third of the deals in the third quarter were financed with debt, a percentage not seen in eight years.

“Trying to win business, big banks in the past few weeks have flown executives to Southern California—where much of the house-flipping activity is occurring—to organize funding deals, say people familiar with the meetings.

“Investors are making an average profit of about $61,000 on each flip, up from about $19,000 at the bottom of the market in 2009, according to housing-research firm ATTOM Data Solutions, which is the parent company of real-estate website RealtyTrac. The calculation measures the difference between the housing value when an investor purchases the home and when it is sold.”

Yesterday’s article added that, “The boom is being accelerated by online lenders such as San Francisco-based LendingHome Corp. and Asset Avenue Inc. in Los Angeles, as well as crowdfunding websites such as Groundfloor Finance Inc., that allow individual investors to fund fix-and-flip loans. LendingHome, backed by venture-capital investors, says it has extended more than $1 billion in loans in the 2½ years since its launch.”

“Loans to house flippers are short term—usually around seven months—and come with interest rates ranging between 7% and 12%. Because real-estate investors are typically higher risk, they put more cash down—sometimes as much as 65%. By comparison, a 30-year home mortgage has an interest rate around 4%, and borrowers typically don’t put more than 25% down,” the Journal article said.