Laura Saunders reported on Friday at The Wall Street Journal Online that, “The American estate tax turned 100 this year. It probably won’t live to see 101.

“Both President-elect Donald Trump and Republicans in the House of Representatives have issued proposals to end the tax, and Senate Finance Committee Chairman Orrin Hatch (R., Utah) has opposed it as well. Launched in 1916, the tax was first imposed to help finance World War I and more recently was meant to limit concentrations of wealth.”

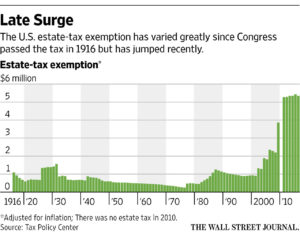

Graph from The Wall Street Journal.

Ms. Saunders indicated that, “Of course, there is no certainty the tax is dead, since it is difficult to predict exactly what Congress will do—or when. Meanwhile, people should sign wills and continue to make certain types of gifts, while postponing others, tax advisers say.

“Under current law, about 0.2% of Americans who die in 2017, or about 5,200 people, are expected to have taxable estates, according to the Tax Policy Center in Washington. This small sliver is far below the high-water mark of 7.7% in 1976, when the estate-tax exemption was $60,000.”

“This shrinkage is due to the growth of the estate-tax exemption. Today, the combined federal estate- and gift-tax exemption is $5.45 million per individual, or $10.9 million per married couple. Inflation indexing will raise it to $5.49 million in 2017,” the Journal article said.

Ms. Saunders added that, “Less clear is what will happen to the gift tax, which applies to transfers during life, and to an income-tax provision known as the ‘step-up.’ The step-up often allows assets held at death to bypass capital-gains tax. This provision applies to all assets, including those that have been held for decades and are highly appreciated.

“Mr. Trump’s proposal appears to say that the step-up would disappear above an exemption of up to about $10 million. Beyond that, the dead person’s cost of the asset—the starting point for measuring capital-gains tax—would transfer to the heir.”

The Journal article also stated that, “Don’t wait to sign a will. Whether or not you are subject to estate tax, it is important to have a valid will—period.”